Content

Sales account is credited when money is received immediately. It helps the customer purchase if he does not have readily available cash to buy something. To reflect this, debit your COGS account $400. When you sell a good to a customer, you’re getting rid of inventory. And, you’re increasing your Cost of Goods Sold Expense account. Your COGS represents how much it costs you to produce the item. Your Accounts Receivable total should equal the sum of your Sales Tax Payable and Revenue accounts.

DebitedDebit represents either an increase in a company’s expenses or a decline in its revenue. Thus, the total balance of current assets will not remain the same. ABC Inc sold goods worth $1,000 to XYZ Inc on January 1, 2019, on which 10% tax is applicable.

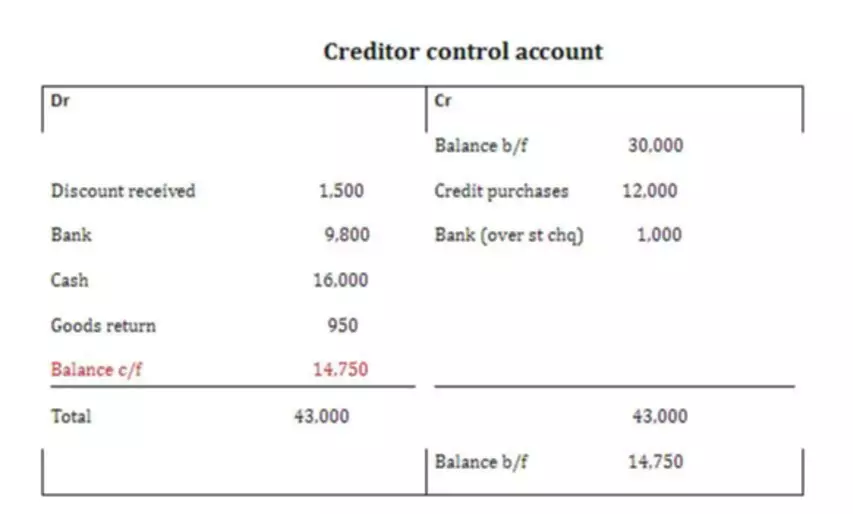

How to record transactions related to the purchasing process

For example, A Ltd sells an Air Conditioner worth $5,000 to Mr. B and agrees to settle the payment after 30 days. This is a form of the credit sales transaction. Which of the following journal entries will record the payment of a $1,700 accounts payable originally incurred for Office Supplies? Calculate the accounts receivable turnover by dividing credit sales by the average opening and closing accounts receivable. The higher the turnover, the more efficiently the company collects amounts owed to it. In the month of May, Company Z had cash sales of $80,000.

What is recorded as credit?

In accounting, a credit is an entry that records a decrease in assets or an increase in liability as well as a decrease in expenses or an increase in revenue (as opposed to a debit that does the opposite).

Instead, the seller offers a certain credit period to the buyer for making the payment. It is a prevalent form of sales transaction these days. In accounting, a credit sales transaction creates a receivable in the books of accounts of the seller. A credit memorandum, aka credit memo, is an articulated form indicating an amount the contractor owes to the client.

What is the Journal Entry for Credit Sales and Cash Sales?

It helps record a certain transaction to maintain the financial statements. Plus, we have also shared how to make an entry if you are a client in the case of the credit memorandum issue. Cash sales, on the other hand, are simple and easy to account for. In the case of cash sales, the “cash account” is debited, whereas “sales account” is credited with the equal amount. When the business receives payment from the customer for the $1,000 receivable, the business records a journal entry like that shown.

Credit sales represent sales not paid immediately at the date of invoice. Let’s say your customer purchases a table for $500 with cash. There’s a 5% sales tax rate, meaning you receive $25 in sales tax ($500 X 0.05). how to record a credit sale When you are a customer of the goods or services and a credit memo is issued, make necessary accounting entries in your books. In the above example, the business has purchased paper and recorded it as an asset.

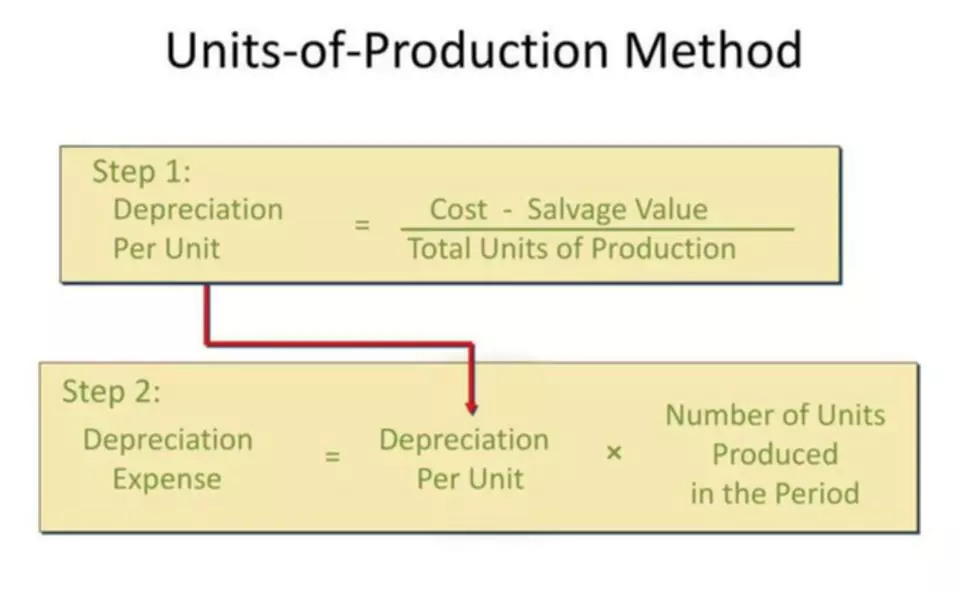

Accumulated Depreciation on Balance Sheet

Liability accounts keep track of debts that a business owes. Asset accounts record the value of a company’s property. Rosemary Carlson is a finance instructor, author, and consultant who has written about business and personal finance for The Balance since 2008. If you want to quickly create a credit note, you can use credit memo/note software and create unlimited credit memorandums. A contractor issues a credit memo to the client. With the issue, the memo reduces the amount that the client owes to the contractor.

‘Buy now, pay later’ revenue jumped 72% last week. That’s a double-edged sword for consumers. – Morningstar

‘Buy now, pay later’ revenue jumped 72% last week. That’s a double-edged sword for consumers..

Posted: Tue, 29 Nov 2022 18:14:00 GMT [source]

Another dent to your goodwill is big sharks may show less or no interest in your company. Businesses record purchases for items that are almost certainly going to be used up in the next 12 months as expenses. There is a decrease/outflow in cash and an increase in the expense .

Practice Questions: Record Sales by Credit Card

This is to match an expense with the revenue. The bad debt expense is debited as part of the overall cost of making the credit sales, and the allowance for doubtful accounts is credited as a reduction to the total amount of accounts receivable.

Credit sales are recorded both on a company’s income statement and on its statement of financial position or balance sheet. On the income statement, it is recorded under revenue along with cash sales as sales. On the balance sheet, it is recorded as accounts receivable signifying that the amount is owed to the company. A lot of retailers use the credit sales option to purchase goods from manufacturers, generate cash when they sell the merchandise, and then pay off the manufacturers from the sale proceeds. When credit sales to some customers become uncollectible, businesses making the sales incur a bad debt expense. Thus, businesses must evaluate the realizable value of their accounts receivable.

How to show Credit Sales in Financial Statements?

The customer contacts Gem and is instructed to return the unacceptable goods. This means that Gem’s net sale ends up being $900; the customer’s https://www.bookstime.com/ net purchase will also be $900 ($1,000 minus the $100 returned). It also means that Gem’s net receivable from this customer will be $900.

- In the case of credit sales, the respective “debtor’s account” is debited, whereas “sales account” is credited with the equal amount.

- If you still have any questions, you can go through the next section.

- Assume Company A sold $10,000 worth of goods to Michael.

- Cash is increased, since the customer pays in cash at the point of sale.

- Sales allowances are basically discounts offered to customers for not requesting full refunds.

Once the sales tax has been selected, Sage 50 automatically calculates and displays the sales tax on the invoice. Invoice Total Sage 50 automatically calculates the total value of the invoice. Once you have entered the information in the Sales/Invoicing window, remember to click the Save icon to save the invoice, journalize the transaction and post it to the applicable accounts. Credit sales journal entries provide an up-to-date record of all credit sales made by the company.